missouri vendor no tax due certificate

My attention at 660-543-8345. The letter verifies that there is no need of registration for salesuse tax because you are not going to make taxable sales in Missouri.

Image Result For Quotation For Food Supply Quotation Sample Quotations Quotation Template Word

The Missouri Department of Revenue will issue a Vendor No Tax Due when a business is properly registered and has all of its salesuse tax paid in full.

. You will only need to provide your contact information once by signing up for a MyTax Missouri account. A business that makes no retail sales is not required by section 144083 rsmo to present a certificate of no tax due in order to obtain or renew. If taxes are due depending on the payment history of the business a cashiers check or money order may be required for payment before a certificate of no tax due can be issued.

Contact person Phone Number. Missouri vendor no tax due certificate. If you do not provide the Vendor No Tax Due certificate andor maintain a compliant tax status it may render your company unacceptable for further consideration for University of Central Missouri contracts.

Jefferson City MO - The State of Missouri is hosting a reverse janitorial vendor fair in Jefferson City on Friday July 29 2022 from 1200 pm. If you need a No Tax Due Certificate for any other reason you can contact the Tax Clearance Unit at 573 751-9268. You will need your businesss Missouri Tax Identification Number and tax filing PIN.

I require a sales or use tax Vendor No Tax Due to obtain or renew a contract with the state of Missouri. If you have questions concerning reinstatements please contact the. The Premium Registration 50 annual fee is not required.

Please enter your MOID and PIN below in order to obtain a statement of No Tax Due. Obtain a vendor no tax due certificate from the missouri department of revenue by following the procedures outlined below. You may review.

The state of Missouri provides you a vendor no tax due certificate if you do not provide taxable services or sell tangible personal property at retail. File a Vendors Use Tax Return - Contact Information. Missouri Department of Revenue Tax Clearance Unit at 573 751-9268.

Information available at httpdormogovforms943pdf. A current Vendor No Tax Due certificate issued by. The individual must be authorized to discuss the confidential information provided in the return.

Copy of EVV Electronic Visit Verification or Telephony contract. A business or organization that has received an exemption letter from the Department of Revenue should contact the SalesUse Refund and Exemption Section at 573-751-2836 or salestaxexemptionsdormogov to request a Certificate of No Tax Due. Has a valid registration with the.

A Vendor No Tax. A business or organization that has received an exemption letter from the Department of Revenue should contact the SalesUse Refund and Exemption Section at 573-751-2836 or salestaxexemptionsdormogov to request a Certificate of No Tax Due. You must provide the contact information for the individual filing this return.

If a business license is not required submit a statement of explanation. The Standard Registration no fee is required. Tax Clearance please fill out a Request for Tax Clearance Form 943.

You may obtain a Vendor No Tax Due certificate by contacting the Missouri Department of Revenue. If you need a No Tax Due Certificate for any other reason you can contact the Tax Clearance Unit at 573 751-9268. Missouri No Tax Due Statements Available Online A business that makes retail sales must obtain a statement from the Department of Revenue stating no tax is due for state withholding tax and state sales tax before a city county or state agency will issue or renew any licenses required for conducting business where goods are sold at retail.

The event will provide janitorial vendors an opportunity to meet with the Office of Administrations Division of Facilities Management Design Construction OA-FMDC and learn about any upcoming janitorial bid. I require a sales or use tax Certificate of No Tax Due for the following. I require a sales or use tax Vendor No Tax Due to obtain or renew a contract with the state of Missouri.

What is vendor no tax due certificate. Mail Fax Taxation Division. A Certificate of No Tax Due is NOT sufficient.

A business or organization that has received an exemption letter from the Department of Revenue should contact the SalesUse Refund and Exemption Section at 573-751-2836 or salestaxexemptionsdormogov to request a. Receive this information Title. If you need.

Reason For No Tax Due. Not be required to obtain a certificate of authority number in Missouri. Local License Renewal Records and Online Access RequestForm 4379A Request For Information or Audit of Local Sales and Use Tax Records4379 Request For Information of State Agency License No Tax Due Online Access4379B.

If you have questions concerning the tax clearance please contact the. Current vendor no tax due letter from the missouri department of revenue. Local Government Tax Guide.

If the name and federal employer identification number are already registered do not submit anything. Select all that apply. If your corporation is not required indicate so and the reason why.

Current Vendor No Tax Due letter from the Missouri Department of Revenue. R Business License r Liquor License r Other if not listed _____ 4. The state of Missouri provides you a vendor no tax due certificate if you do not provide taxable services or sell tangible personal property at retail.

The fax number is 573 522-1265. If you are requesting a No Tax Due use No Tax Due Request Form 5522. Lease agreement or deed for the office location.

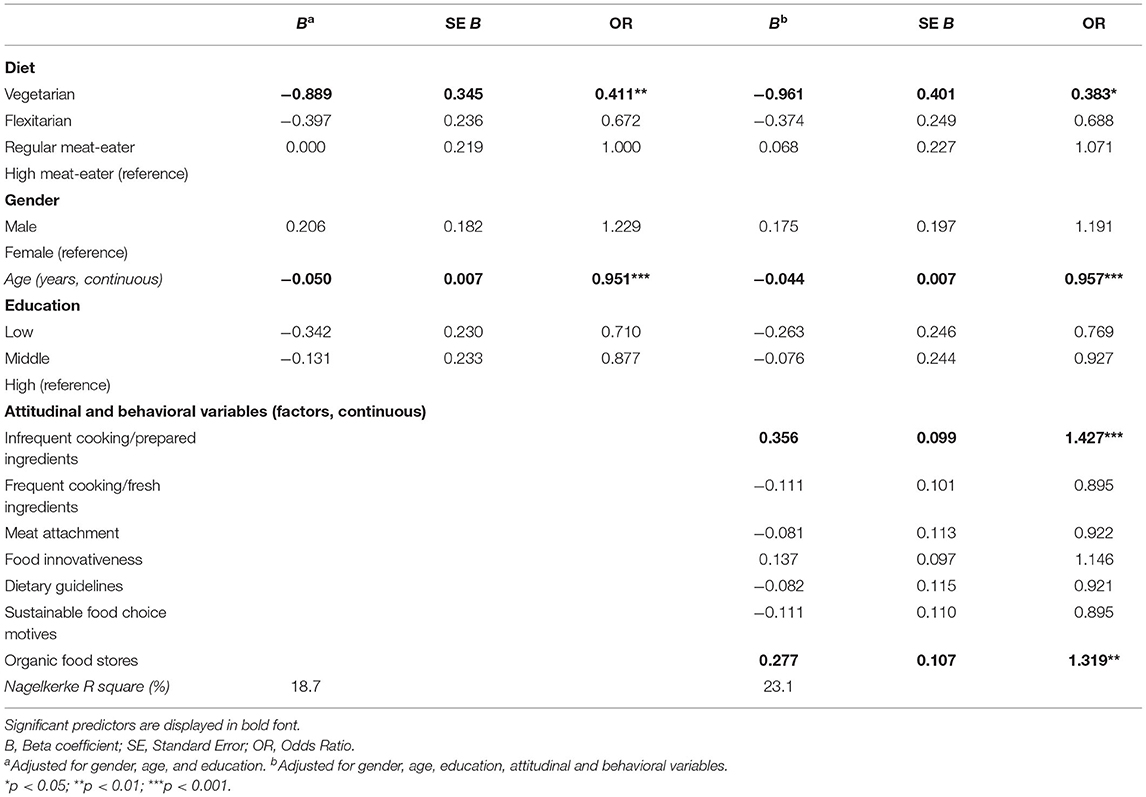

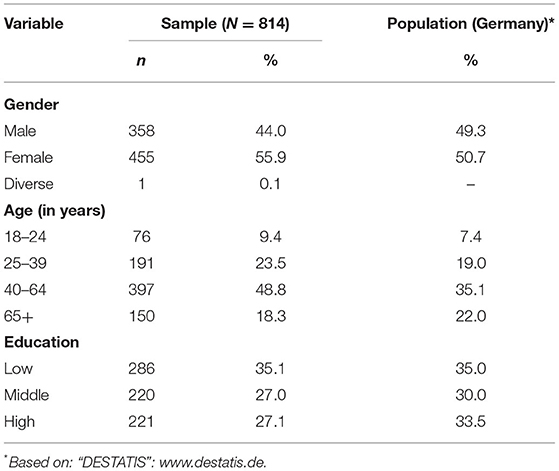

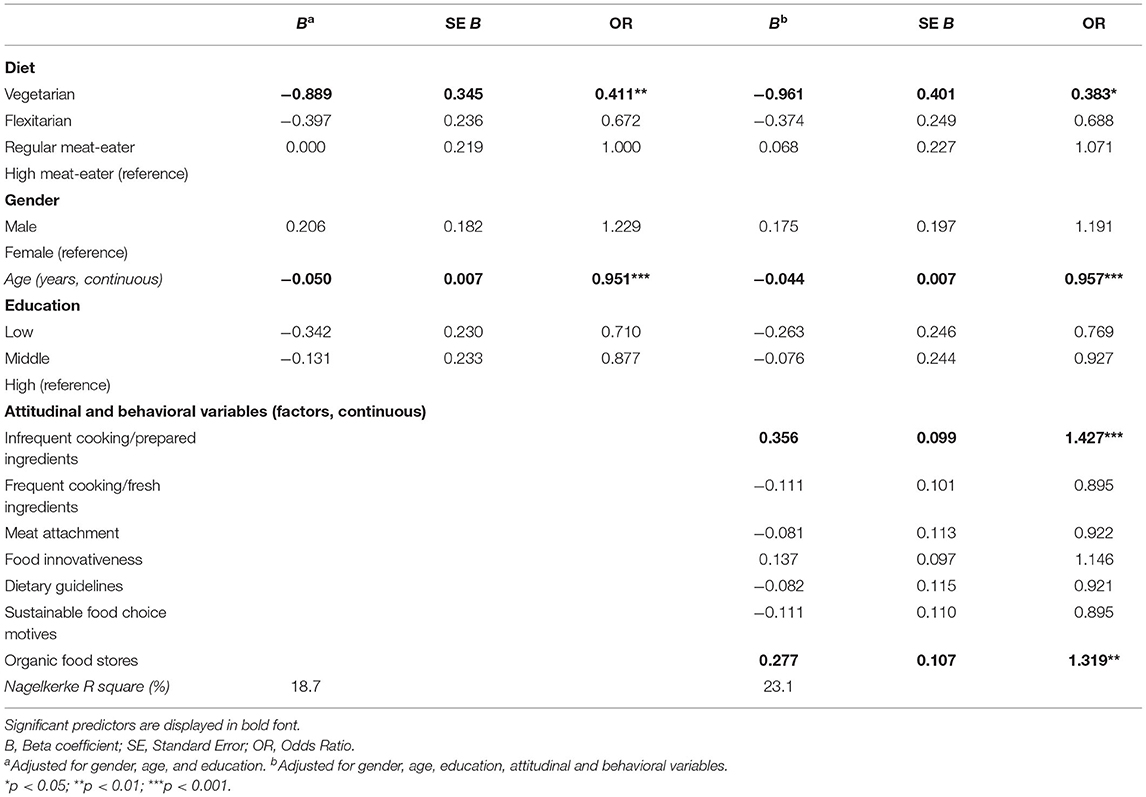

Frontiers Plant Based Diets Are Not Enough Understanding The Consumption Of Plant Based Meat Alternatives Along Ultra Processed Foods In Different Dietary Patterns In Germany

Enabling The Office 365 Securlet

Nnn Lease Versus A Gross Lease What S The Difference

Meet Aspiration Zero The Credit Card That Rewards You For Going Carbon Neutral Fight Climate Change With Every Credit Card Swipe Go Cards Aspire Credit Card

Notary Public Business Card Zazzle Com Notary Public Business Notary Public Notary

Frontiers Plant Based Diets Are Not Enough Understanding The Consumption Of Plant Based Meat Alternatives Along Ultra Processed Foods In Different Dietary Patterns In Germany

Free Online Receipt Maker Fake Business License Fake Receipt Us Receipt Maker Receipt Letter Of Employment

Price Quotation Letter Format In Word

Introducing Cobrabraids Tech Bracelet With Up To 10 Feet Of 550 Paracord And Embedded In The Bracelet Is A 4gb Usb D Tech Bracelet Paracord Paracord Bracelets

Clean Energy Certificates Future Technologies Siemens Energy Global

:max_bytes(150000):strip_icc()/thinkstockphotos470148359-5bfc2fd1c9e77c002631283f.jpg)

/GettyImages-956878656journeycrop-financialplan-989aec6f99e941ebb565e596e6727cae.jpg)